-

22 June 2025 | Country Update

Capitation payment for gynaecologists to improve access and preventive care -

19 June 2025 | Policy Analysis

Major amendments to public health insurance and ehealth legislation -

19 June 2025 | Country Update

First-trimester combined screening as part of new prenatal care strategy (pilot project) -

25 February 2025 | Country Update

Aneurysm screening and Be Fit 24: Initiatives in the 2025–2035 National Cardiovascular Plan -

31 July 2023 | Country Update

Changes in public health protection -

03 February 2023 | Country Update

Reducing administrative burden and occupational medical examinations for those in non-risk professions -

01 January 2022 | Country Update

The state contributions into the health insurance system for the economically inactive population are now automatically linked to the performance of the Czech economy

3.3. Overview of the statutory financing system

Amendments to two laws – on public health insurance and electronic healthcare – passed the Czech Senate in June 2025. Both amendments now await the President’s signature and are expected to come into effect in January 2026.

Act on Public Health Insurance

According to the Minister of Health, the amendment aims to enhance the efficiency of healthcare financing, strengthen the role of health insurance funds and promote preventive care, with the overall goal of improving access to healthcare.

A key change is the restructuring of mandatory accounts within health insurance funds. The amendment abolishes reserve accounts and introduces a new account for public benefit activities (Fond obecně prospěšných činností), which will support initiatives aimed at improving healthcare quality. This includes partial financing of physicians’ specialty training, DRG activities conducted by the Institute of Health Information and Statistics (ÚZIS), and selected activities of patient organizations. Notably, health insurance funds will now be able to support residency training positions in specific regions or specialties, a role previously limited to the Ministry of Health, which is required to offer equal conditions nationwide.

The amendment also increases the permissible allocation for health promotion programmes from 0.5% to up to 3% of collected premiums. It intends to expand the possibilities of health insurance funds to offer benefits to insured individuals who take good care of their health. However, insurance funds may only access the increased budget if their financial situation is balanced.

Further changes include the possibility of receiving covered health services abroad up to the amount of local reimbursement if these services are unavailable in Czechia or if it is more efficient for the health insurance fund. This concerns both long-term and repeated use of care. Health insurance funds will be allowed to contract directly with foreign providers for such care.

Reimbursement for medical devices will now fall under a separate Act on the Categorization of Medical Devices, aimed at ensuring more flexible and timely responses to technological advances and evolving patient needs.

The amendment also aims to increase the accessibility of dental care. It responds to the ban on the use of amalgam dental fillings. Insurance funds will therefore reimburse their adult insured persons for the cheapest available white filling, or partially reimburse a higher-quality alternative.

Other passed changes include a report on the network of contractual providers of outpatient care in the fields or services specified in the governmental regulation on the local and temporal accessibility of health services (with the exception of pharmacies) and home care. This report will be published annually, by the end of November, by each health insurance fund. Furthermore, the health insurance funds will have the opportunity of centralized procurement for supplies of “centre” medicinal products for highly specialized providers. Also, the selection procedures at the regional offices before concluding a contract with the insurance fund will be eliminated. Decisions to contract a new provider will rest solely with the insurance funds.

Health insurance funds criticized the abolishing of the reserve account and the obligation to finance the management of the DRG system. The Ministry of Health countered by saying that the reserve accounts were not used in the past, even when the specific situations which the reserve accounts were established for occurred.

Furthermore, following substantial criticism, a proposed clause that would have allowed health insurance funds to seek (partial) reimbursement for care provided to individuals injured while committing illegal activities was removed from the final version.

Act on Electronic Healthcare

This amendment seeks to improve communication across the healthcare system and promote safer, higher-quality service delivery through digital tools.

The instruments introduced include:

- Electronic vaccination card

- e-Referrals

- Central register of preventive examinations

- Electronic vouchers for medical supplies (for example, crutches, bandages)

The “core” register is expected to be expanded to include, for example, data on medical fitness to drive motor vehicles, possession of weapons or ammunition permits. The shared health record will be divided into two parts – an emergency record with key data (for example, blood type, allergies) and a record of the results of preventive and screening examinations.

Medical check-up requirements for older drivers will also change. Instead of beginning at age 65, mandatory check-ups will now start at age 70. Drivers will no longer need to carry physical proof of these check-ups; police will verify them via digital records.

References

https://www.senat.cz/xqw/xervlet/pssenat/historie?cid=pssenat_historie.pHistorieTisku.list&forEach.action=detail&forEach.value=s5450 (Senate Press No. 103)

3.3.1. Coverage

Breadth: who is covered?

Entitlement to SHI coverage is based on permanent residence, not on SHI contributions themselves. All people residing in Czechia are subject to compulsory SHI enrolment, including Czech citizens and permanent residents. Individuals who are not permanent residents are also covered if they are working for a Czech-based employer. EU nationals who do not fulfil these conditions and who stay for longer than 90 days in Czechia have the option of participating in the Czech SHI system; if they choose not to participate, they must be insured through their country’s insurance system or be privately insured. As health insurance is compulsory, non-EU nationals without permanent residence and not working for a Czech-based employer must purchase PHI if they wish to remain in the country (see section 3.5). These provisions result in virtually 100% population coverage. Czech nationals living abroad who do not wish to contribute to SHI must explicitly deregister from their Czech HIF, and EU regulations on coverage apply for Czechs located in other EU countries.

For permanent residents and those working for Czech-based employers, opting out of the SHI system is not possible. Similarly, HIFs must accept all applicants who have a legal basis for entitlement; risk selection is not permitted. Individuals may choose freely among HIFs.

Scope: what is covered?

The range of benefits covered by SHI in Czechia is very broad and includes inpatient and outpatient care (including home care), prescription pharmaceuticals, some dental procedures, rehabilitation, spa treatments and over-the-counter pharmaceuticals (the last three if prescribed by a physician). This is in accordance with Czech law, which stipulates that insured individuals are entitled to any medical treatment delivered with the aim of maintaining or improving their health status. In practice, however, benefits are rationed by a combination of means, including legislation, formularies, an annual negotiation process between HIFs and providers aimed at defining specific conditions of reimbursement and the LHS.

The first mechanism by which benefits are rationed is the Health Insurance Act, which excludes procedures and services either implicitly or explicitly. Examples of implicitly excluded services are voluntary abortions, examinations requested by employers and various medical certificates, as these do not meet the requirements of maintaining or improving health status. Examples of explicitly excluded services are cosmetic surgery, acupuncture and some dental treatments, which are specified in a negative list contained within the first Annex of the Health Insurance Act. This also defines exceptional cases in which items on the negative list may be covered by SHI. Other annexes contain: a list of substances for which at least one pharmaceutical should always be fully covered (the second Annex); the categorization of MDA, including prescription, indication and volume reimbursement limits (the third Annex); dental aids and procedures that may be reimbursed under the SHI system (the fourth Annex); and an indication list for spa treatment covered by SHI (the fifth Annex) (Health Insurance Act, 1997).

Formularies are the second mechanism by which benefits are rationed. In essence, these are positive lists of approved pharmaceuticals that may be reimbursed under SHI. The list of pharmaceuticals covered by SHI and the depth of coverage are set by SÚKL (see section 2.7.4). Previously, formularies were also used for medical and dental aids, but legislative changes in 2019 revised the definitions of content in the annexes of the Health Insurance Act. An item not included in the formularies or in the positive lists in the above law’s annexes may still be reimbursed if it is the only remaining potentially effective treatment for a specific patient. This decision is made by the respective HIF; since January 2022, the decision procedure is newly set in an amendment (see section 6.1).

The third means by which benefits are rationed is an annual negotiation process between HIFs and providers (see section 3.3.4). In the negotiation process, the reimbursement conditions and prices for health care should be set in a consensual way. MZČR moderates the negotiation process and in the end issues the so-called Reimbursement Directive, which serves as a guideline for annual amendments to the purchaser–provider contracts on specific conditions of reimbursement. From the patient perspective, this can result in limitations of volume of services provided by specific providers.

Finally, the fourth mechanism by which benefits are rationed is the LHS (see section 2.7.3). Although the LHS functions in everyday practice as a positive list of benefits, services that are not specified in it may still be reimbursed depending on the needs of individual patients. In 2022, the LHS contained more than 3995 items (MZČR, 1998, 2021a).

The following details the most important services that are fully or partially covered by SHI:

- preventive services (such as examinations, screening, vaccinations)

- diagnostic procedures

- curative ambulatory and hospital care, including rehabilitation and care of the chronically ill

- some dental treatments

- pharmaceuticals and medical aids

- psychotherapy

- IVF under certain conditions

- medical transportation services

- spa treatments (if prescribed by a physician)

- emergency health services.

Several treatments, such as spa therapy and some types of dental and cosmetic procedures, necessitate patients obtaining permission via prior authorization from their HIF to be covered. Above the statutory benefits package, additional benefits may be offered by HIFs only in the field of extra prevention (for instance, for reimbursements for voluntary vaccinations not covered by SHI like tick-borne encephalitis, extra screenings, mammography for younger women, safety helmets for children, vitamins and health promotion activities).

Sick pay, maternity benefits and social care allowances are not covered by SHI, but are part of the state social security system, which is also responsible for pensions, unemployment compensation and other social benefits. This system is financed through social security contributions and general taxation.

Depth: how much of benefit cost is covered?

Most health services covered by SHI are provided free of charge at the point of use (see Box3.1). Except for pharmaceuticals and MDA, partial coverage is not permitted – that is, patients cannot top up their statutory coverage by choosing a treatment that is more expensive than one normally covered and paying for the difference. Patient co-payments are only permitted for above-standard hotel-like services in hospitals and for accommodation during spa treatments. This applies also to dental care, for which only some treatments are covered by the HIFs; treatments not covered are paid in full directly by the patients based on prices set by the dentists.

Box3.1

There have been almost no user fees applied since 2015, though one remaining user fee (CZK 90) is for accessing out-of-hours outpatient care. A wider range of small user fees introduced in 2008 proved politically divisive and were gradually removed and fully abandoned. An annual ceiling for pharmaceutical co-payments, also introduced in 2008, continues to be applied; exemptions from the out-of-hours outpatient care fee apply for people living below the poverty line.

Authors

Authors

In February 2025, the Ministry of Health introduced a new National Cardiovascular Plan for 2025–2035 to strengthen prevention and reduce the proportion of Czech residents with heart and vascular diseases. This emphasis on prevention includes new screening options and the promotion of healthy lifestyles. As such, a new screening for abdominal aortic aneurysms and the “Be Fit 24” program have been launched, fully covered by the health insurance funds. The plan also includes new guidelines supporting the effectiveness of GPs’ preventive examinations.

The new screening program for abdominal aortic aneurysms started on 1 January 2025. It is intended for men aged 65–67 and can be joined via their GPs. Its goal is to detect aneurysms early and collect key data that will make health statistics more accurate.

Be Fit 24 is a program promoting healthy lifestyles in overweight children aged 6–11. The goal is to reduce their BMI by 5% within one year. Eligible children can enrol via their paediatrician. Each child participating in the program receives a free Garmin Vivosmart 5 fitness tracker and access to a mobile app similar with game-like features. This app allows children and their parents/guardians to track daily physical activity, energy intake and daily activity, and achievement of healthy eating and exercise goals. If a physician is not involved, a free fitness bracelet will not be provided, though the mobile app can still be downloaded. A new educative web also informs about nutrition, exercise and obesity prevention, where parents/guardians and children can get practical advice and tips on lifestyle changes (https://www.nzip.cz/bf24).

Authors

References

At the end of May 2023, Act No. 167/2023 Coll., amending Act No. 258/2000 Coll., on public health protection, and related acts, passed the legislative process. This amendment stipulates, among others, the following:

- From 1 July 2023, irregular vaccinations can also be administered by providers in the fields of hygiene and epidemiology, complementing providers that already offered these (those in infectious medicine, general medicine for children and adolescents, general medicine or providers of occupational medicine services and health institutes) (Act No. 258/2000 Coll., on public health protection, as amended).

- Also from 1 July 2023, workers who come into direct contact with food no longer need health certificates issued by physicians (Act No. 146/2002 Coll., on public health protection, as amended).

- From 23 October 2023, heated tobacco products with a characteristic flavour are prohibited, just as cigarettes with a characteristic flavour and tobacco intended for hand-wrapping cigarettes with a characteristic flavour (Food and Tobacco Products Act No. 110/1997 Coll., as amended).

- From 1 January 2024, statutory health insurance in Czechia will fully cover vaccination against HPV for all individuals aged 11–15 years. The above-stated amendment broadens the age range that was previously set at 13–14 years. Similarly, the age range for meningococcal vaccinations will be broadened from 14–15 years to 14–16 years (Health Insurance Act No. 48/1997 Coll., as amended).

Authors

References

Act No. 167/2023 Coll., amending Act No. 258/2000 Coll., on public health protection, and related acts

Health Insurance Act No. 48/1997 Coll., as amended

Act No. 258/2000 Coll., on public health protection, as amended

Food and Tobacco Products Act No. 110/1997 Coll., as amended

Act No. 146/2002 Coll., on public health protection, as amended

As of 1 January 2023, periodic occupational medical examinations are no longer obligatory for employees in non-risk professions (as defined in Public Health Protection Act no. 258/2000 Coll.). From now on, these examinations will only be performed upon the request of either the employer or the employee. The Ministry of Health agreed upon this with the Czech Chamber of Commerce and the Confederation of Industry of the Czech Republic. The policy change is defined in Directive no. 452/2022 Coll. amending Directive no. 79/2013 Coll. on occupational health services and certain types of assessment care. The provision of periodic examinations remains mandatory for defined “risky” professions. Entrance medical examinations also remain mandatory for all employees.

According to the Czech Minister of Health, this should not only lead to a reduction in administrative burden but also to annual savings of hundreds of millions of crowns on the part of employers and significant time savings for physicians and employees. The Ministry of Health will continue cooperating with employers to maintain quality care for employees by supporting prevention without redundant bureaucracy.

Authors

References

Public Health Protection Act no. 258/2000 Coll., as amended

Directive no. 452/2022 Coll. amending the Directive no. 79/2013 Coll. on occupational health services and certain types of assessment care

Ministry of Health. Press release 20 December 2022. “Ministerstvo zdravotnictví ruší povinné periodické pracovnělékařské prohlídky u nerizikových profesí.” [The Ministry of Health cancels mandatory periodic occupational medical examinations for non-risky professions]. https://www.mzcr.cz/tiskove-centrum-mz/ministerstvo-zdravotnictvi-rusi-povinne-periodicke-pracovnelekarske-prohlidky-u-nerizikovych-profesi

3.3.2. Collection

The vast majority of health care expenditure is financed through the SHI system, which is financed primarily from earmarked payroll taxes (wage-based contributions) and, to a lesser degree, from the state budget’s general tax revenue transfers on behalf of the state-insured parts of the population. General tax revenue is also responsible for additional public expenditure in the health care sector, such as state or regional investment subsidies to providers, while private expenditure is mainly tied to OOP spending.

General government budget

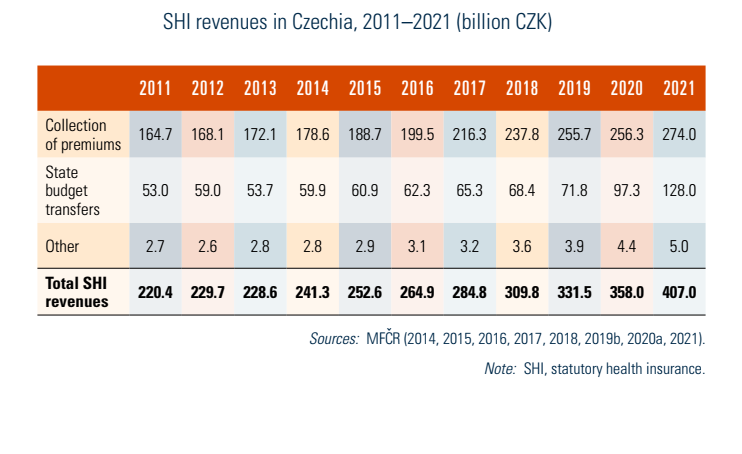

The state budget transfers monthly SHI contributions (set per capita payments) on behalf of defined state-insured people. These transfers represented 27% of SHI revenues in 2020 (Table3.3). The general tax revenue of the entire state budget consists of value-added tax (21%), income taxes from individuals and corporations (21%), social security contributions (39%; not including SHI contributions) and consumption taxes (11%), though none of these are earmarked specifically for health (MFČR, 2020b).

Table3.3

State-insured individuals and groups are defined by law and include: children, students, women or men on parental leave, pensioners, unemployed individuals, people living below the poverty line, prisoners and asylum seekers (see Box3.2). During the response to the COVID-19 pandemic, the monthly state SHI contribution per person rose from CZK 1067 (January 2020) to an unprecedented CZK 1567 per person in June 2020. Further increases in 2021 (CZK 1767) and 2022 (CZK 1967 per person) resulted in a state per capita payment increase of 84%, greatly contributing to the jump in current health expenditure’s share of Czech GDP (Bryndová & Šlegerová, 2021). In September 2022, the per person transfers decreased to CZK 1487 (Act no. 260/2022 Coll.). While the state budget contribution for per capita payments had been set by governmental decree, many adjustments over the past decade led to legislation to link it automatically to economic performance beginning in 2024 (see section 6.1).

Box3.2

Statutory health insurance contributions

Each HIF collects SHI contributions, apart from the state payments described above, independently. These SHI contributions are collected monthly from employers and employees (employers are tasked with collecting contributions), the self-employed, and individuals without taxable income who do not qualify for any of the state-insured groups. Self-employed individuals make advanced payments, which are accounted annually.

SHI contributions are legally set at 13.5% of pre-tax monthly wages for employees, with the employees paying a 4.5% share and employers a 9.0% share, while the self-employed pay 13.5% of their contribution base, defined as 50% of their profits (Act no. 592/1992 Coll.). There has been no annual ceiling on contributions since 2013, though there is a legally defined minimum contribution base for employees and employers, equal to the monthly minimum wage. For individuals without taxable income who do not qualify for any of the state-insured groups, 13.5% of the monthly minimum wage applies. The minimum monthly contribution base for self-employed persons is 50% of the average monthly wage in Czechia from two years prior, multiplied by a conversion factor set by the government.

References

3.3.3. Pooling and allocation of funds

Allocation from collectors to pooling agencies

All SHI contributions are managed by HIFs, including state budget transfers on behalf of state-insured people. The state budget transfer is defined by the number of people in the legally defined groups. Wage- and income-based contributions are also set in law. SHI revenues are fully subject to redistribution among HIFs according to a risk-adjustment scheme.

The reallocation process of resources among HIFs is calculated by MZČR through a special central account of VZP, which serves as a clearing centre. Monthly payments are transferred from the state budget to this account, where it is then used to clear the net surpluses and deficits among HIFs, who retain collected premiums from the rest of the population. If HIFs have net surpluses above the sum of their collected premiums (that is, collected premiums are higher than risk-adjusted allocations), then they refer surpluses to the central account to be reallocated.

The reallocation process takes place monthly and is conducted one month after the respective collection of premiums. HIFs provide information on their premium collection, together with information on the statistical and health risks of their insured members, to MZČR, which supervises the risk-adjustment process and the redistribution mechanism, and runs the necessary calculations.

Allocating resources to purchases

VZP is the largest HIF with a market share of 56% in 2020; the second and the third largest HIFs have similar market shares of around 12% (MZČR, 2020b). Individuals may choose freely among HIFs and may switch no more than once every 12 months, provided they have applied at least three months before the swap dates, which are 1 January and 1 July (before 2015, there was only one swap date per year). The percentage of individuals who switch is very low, slightly above 1% in recent years, as there is little true competition between the funds.

Risk adjustment and redistribution of SHI revenues among HIFs have been in place since the 1990s, with significant change in scope and definition of the redistribution formula having taken place in 2004–2006 (see Box3.3). The last change occurred in 2018 and added an adjustment to the redistribution mechanism for clients with chronic diseases identified by their pharmaceutical consumption, using PCGs (see section 6.1). The reform also redefined the reinsurance tool by changing the rules for retrospective compensation and the definition of very high-cost patients. (Reinsurance here refers to the “insurance-of-the-insurers” mechanism used to cover HIFs’ costs for exceptionally expensive patients. This takes the form of retrospective compensation for HIFs from an explicitly reserved share of pooled funds as part of the overall redistribution scheme.)

Box3.3

The risk-adjustment mechanism aims to maintain solidarity in both revenue and the expenditure within defined age–sex risk groups, and to take account of specific chronic conditions that are either very common or expensive (or both). Its second component, the retrospective partial compensation, aims at solidarity in the context of excessive health risks and reinsures HIFs against above-average numbers of very high-cost patients, which could lead to financial issues. The Czech redistribution scheme is zero-sum; though HIFs do not purchase reinsurance, they pay an implicit premium for it. The reinsurance set share is defined by MZČR, which has the discretion to adjust the share of the pooled funds used based on a defined formula. Two attachment points are defined: an 80% reimbursement rate for excessive patient costs above a certain cost level and a 95% reimbursement rate above a higher patient cost level (Bryndová, Hroboň, & Tulejová, 2019).

The Czech PCG model is based on the 2012 Dutch classification of PCGs. It allows for patients to be categorized into more than one PCG, based on consumption of a given pharmaceutical over the previous 12 months. Twenty-five PCGs were introduced in 2018 and include diabetes, depression, transplantation, renal failure and HIV. In addition to PCGs, 38 age–sex interacted risk groups are used. Risk indices are calculated based on individual-level claims data of the insured population. For more information on the prospective risk indices calculation and the reinsurance setting, see Bryndová, Hroboň & Tulejová (2019).

Further adjustments to the definition of PCGs were made in 2021 and 2022, resulting in 30 PCGs in 2022 (four new groups added, two groups split in two, and one PCG dropped for not meeting the statistical thresholds) and revisions to the ATC classification requirements to reflect the current trends in pharmacology.

3.3.4. Purchasing and purchaser–provider relations

HIFs serve as the main purchasers of health services in Czechia. The purchasing process is regulated by the state, as is the relationship between HIFs and providers, though HIFs are allowed to contract selectively (namely, they are not required to have contracts with any specific provider). In practice, all HIFs have contracts with virtually all inpatient facilities; networks of contracted outpatient providers may differ according to geographic scope. They are obliged to ensure the provision of SHI-covered services to their members, including local and timely availability of health services (see Box4.2 and section 5.4.1). This obligation is fulfilled by HIFs through their contracted providers, though HIFs’ oversight and monitoring of health care availability are limited.

Box4.2

There is no true competition between providers for contracts from purchasers. Generally, it is not a common practice to cancel existing contracts from the HIFs’ side. Such cases are also rare for political reasons.

Both the state and regional authorities play an important role in the process of arranging new contracts. Whenever an inpatient care provider requests a contract with HIFs or vice versa, MZČR is responsible for assembling a committee consisting of HIF representatives, care providers, professional medical associations and other interested groups (such as the Czech Medical Chamber). The committee makes non-binding recommendations as to whether a provider should or should not be contracted by a respective HIF – among the main criteria are density and availability of existing contracted providers. The same procedure is initiated by regional authorities whenever a new contract with an outpatient care provider is requested. Here, too, the recommendation of the committee is non-binding in terms of requiring HIFs to sign a contract. However, no contract can be signed between HIFs and providers without this (sometimes lengthy) selection process (výběrové řízení) and unless its recommendation is in favour of closing the contract.

HIFs sign long-term contracts with individual providers for a period of either five or eight years, depending on the type of provider, often with automatic extensions enshrined directly in the contract. The default binding contract for each type of provider is specified in the Directive on Framework Contracts issued by MZČR and includes necessary conditions for providing health care, such as the staffing and technical equipment, general payment mechanisms, conditions for ending the contract, and other rights and obligations of purchasers and providers (MZČR, 2006). The framework contracts do not, however, include the specific conditions of reimbursement, which are subject to annual amendments to the contracts either based on individual agreements between providers and HIFs, or on the annually issued Reimbursement Directive.

MZČR acts as a mediator and final arbiter in the reimbursement setting process; it hosts and supervises annual negotiations between HIFs and specific groups representing providers (such as acute care hospitals, physicians and outpatient care specialists) to determine the conditions of reimbursement, including payment mechanisms. Agreements between stakeholders must be reached by June and published by October for the upcoming year. If an agreement is reached (though MZČR has the right to alter agreements), MZČR publishes the result in the Reimbursement Directive (expanded upon during the COVID-19 pandemic; see Box3.4). If an agreement is not reached for certain types of providers, MZČR determines the specific conditions of reimbursement for that group of providers, including the payment mechanisms and volume limitations, in the Reimbursement Directive itself.

Box3.4

Using the Reimbursement Directive as a guideline, individual HIFs and individual providers then draw up amendments to the long-term contracts previously described. If no agreement is reached between an individual HIF and an individual provider, the Reimbursement Directive’s specific reimbursement conditions become binding for both parties for that particular year.