-

12 December 2023 | Policy Analysis

The health system financing “consolidation package” -

08 October 2018 | Country Update

Revised risk-adjustment scheme and evaluation

3.2. Sources of revenue and financial flows

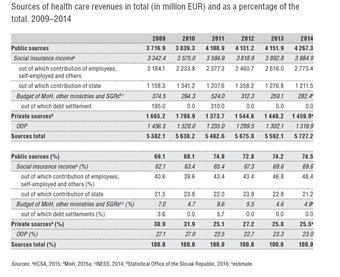

Public resources accounted for 74.5% of total financial means in the system in 2014, out of which contributions paid to the HICs accounted for 69.6% (see Table3.3). Compulsory health insurance contributions are collected by three HICs: the state-owned GHIC with approximately two-thirds share of the market, the privately owned Dôvera exceeding one-quarter share and the rest is covered by privately owned Union. Contributions come from employees and employers, self-employed, voluntarily unemployed, state insured (comprising mainly economically inactive persons, e.g. retired, children, unemployed) and dividends. “State insured” is a term used for the significant group of mostly economically inactive persons for whom the state pays contributions from general tax revenue.

Table3.3

Apart from the state insured, the central government budget finances the activities of several ministries, most notably the Ministry of Health (total of 4.9% in 2014). This proportion fluctuates, partly due to the extra allocations made for debt settlements of hospitals in 2009 and 2011. The Ministry of Health also funds several health agencies, such as the PHA and the state-run Slovak Health University. It also covers small capital investments in some state hospitals directly. Lastly, self-governing regions and municipalities are responsible for capital investment in their hospitals and outpatient centres, but their contribution is estimated to be a relatively small 0.1% of total resources.

Private resources accounted for 25.5% in 2014, which mostly (about 90%) consisted of OOP payments. The remaining private sources included investment activities of private entities and informal payments. Because of the very broad definition of the benefits package, voluntary health insurance (VHI) plays only a very marginal role. See Fig3.6 for an overview of the system.

Fig 3.6

Slovakia’s new government has approved a “consolidation” package of measures (18 in total) to bring down their existing budget deficit. By increasing taxes, fees and other contributions, the new government’s plans are thus far only on the revenue side of public finances and are forecast to bring in an additional EUR 1.96 billion.

Regarding the health system, the major measure included in the new package concerns increasing the employer contribution rate the SHI system by 1 percentage point, from 10% to 11%. The employee contribution remains flat at 4%, while the self-employed contribution rate will also rise, from 14% to 15%. These rate rises will generate an additional EUR 357 million. Before the parliamentary elections in September 2023, all political parties declared interest in raising additional revenues (that is, tax hikes) and increasing the general transfers to the health system from the state budget, while the idea of increasing the contribution rates was not campaigned on. The rising contributions rates for employers and the self-employed has likewise surprised analysts. For example, Dušan Zachar from the Institute for Economic and Social Reforms (INEKO) argued for instead increasing consumption taxes and legalizing co-payments in the health system, while Martin Vlachynský from the Institute of Economic and Social Studies (INESS) pointed out that these rate increases are not linked to quality or quantity metrics.

Additionally, and according to the larger budget proposal, the payment for the so-called “state insured” will reach EUR 2.1 billion next year, which is approximately the same level as in 2023 but a massive increase compared to EUR 1.2 billion in 2022. This high increase was partially driven by the vision to increase the state payment to the level comparable with neighbouring Czechia, among other measures taken in 2023. According to analyst Martin Smatana, in 2022, the Slovak state paid EUR 31 per state-insured person monthly, while in Czechia the payment was EUR 72 per person. This difference decreased in 2023: EUR 60 was spent per capita on the state insured in Slovakia against EUR 78 in Czechia.

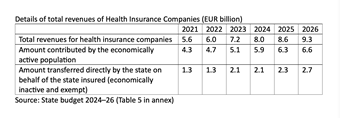

Altogether, the pooling and distribution of revenues to Slovakia’s three health insurance companies will reach roughly EUR 8 billion EUR in 2024, which represents about a 25% jump from 2022 levels (see Table 1). This was confirmed by State Secretary of the Ministry of Health, Michal Štofko, in his interview with the publication Denník N in December 2023. According to State Secretary Štofko, this money should be used to (1) cover the potential debt of state hospitals, (2) increase hospital productivity and (3) provide new resources to introduce a new catalogue of services in outpatient care.

Table 1

Despite this and the other 17 measures in the package, the credit rating agency Fitch downgraded Slovakia’s rating to “A−”. The main reasons for this are

- overall deteriorating public finances,

- wide deficits,

- an uncertain fiscal consolidation trajectory and

- an upward trajectory of debt.

References

https://www.mfsr.sk/files/archiv/66/KONSOLIDACNE-OPATRENIA-2024.pdf [Consolidation package 2024]

https://hsr.rokovania.sk/mf0180772023-41/?csrt=16838386985454613868 [State budget 2024–26]

https://rokovania.gov.sk/RVL/Material/29105/1 [State budget 2024–26]

The threshold for the ex-post redistribution is defined as a 20-multiple of the average costs (national cost average) above the insurees real costs (PCG + demographical expected costs), this model is applied to every insuree individually. To prevent an effectivity decrease in spending from the side of HICs, only 80% of this amount are directly redistributed (approximately 4% of the total redistribution) and 20% are redistributed based on the above-mentioned indexes.

In order to provide needed clarity and transparency into the scheme, HICs and MoH contracted a Dutch company to reassess its system and suggest improvements in the scheme.

The project was finalised in May 2018 and based on its outputs, the MoH will have introduced several changes that will further improve predictability.