-

09 October 2025 | Country Update

Medical use of cannabis approved -

10 December 2024 | Country Update

Presentation of the 2024–2028 Spanish Pharmaceutical Industry Strategy

5.6. Pharmaceutical care

The Spanish pharmaceutical sector is one of the most regulated sectors of the Spanish economy (Bernal-Delgado et al., 2018) (see also section 2.7.4 Regulation and governance of pharmaceuticals and section 6.1 Analysis of recent reforms).

Pharmaceutical care, as part of the SNS common benefits package, covers all medicines and health products approved, registered and eligible for reimbursement (see section 3.3.1 Coverage). The basket does not include cosmetic formulae, dietary products, mineral water, elixirs, toothpaste and other health products, over-the-counter medicines, homoeopathic remedies, or any advertised item or accessory targeting the general population. Pharmaceutical care is provided by a) doctors, as prescribers and overall supervisors of treatment; b) nurses, particularly in PHC, in their role as supervisors of adherence and side-effects, and prescribers of a protocolized list of drugs; and c) pharmacists, as dispensers and health community agents, supervising treatment adherence and early detection of side-effects.

Regarding the distribution of medicines, the system is organized around wholesalers, mainly made up of cooperatives of pharmacists. In 2021, 19 companies had 97% of the market share (with four of these companies having a 70% market share) of pharmaceutical distribution in Spain (FEDIFAR, 2022), comprising 22 198 pharmacy retailers (which are independent authorized agents that enjoy protective regulation that limits competition at the level of distribution) (General Council of the Official College of Pharmacists, 2023). Regulations restrict the dispensation of prescription drugs to qualified pharmacists, include rules to prevent the geographical concentration of pharmacies, and, especially, require a five-year university degree – not only to dispense but also to own a pharmacy – and compulsory enrolment in the College of Pharmacists (Law 16/1997). The authorization to open a pharmacy entails an automatic agreement with the regional health authorities for the dispensation of medicines prescribed in the SNS. In the case of drugs eligible for public reimbursement, the reimbursement of retail pharmacists and wholesalers relies on fixed and price-proportional mark-ups of the consumer price before tax.

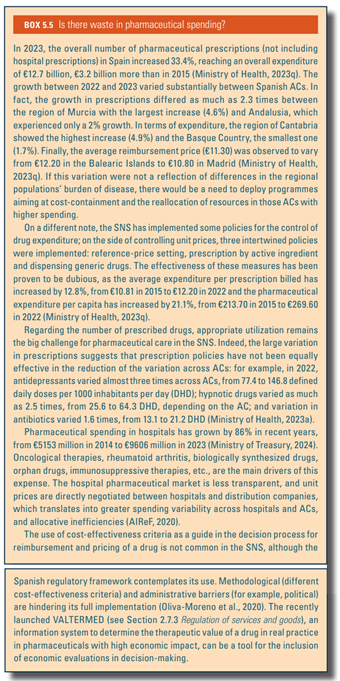

Box5.5 discusses the key issues in Spain with regard to waste in pharmaceutical spending.

Box5.5

The Spanish Government has approved a Royal Decree regulating the use of cannabis preparations in hospital care and under specialist prescription. In the next three months, the Spanish Agency of Medicines and Medical Devices (AEMPS) will establish the clinical indications, along with the specific conditions for preparation, dosage and prescription.

The decree also creates a public register, managed by the AEMPS, for standardized cannabis preparations manufactured by laboratories. These laboratories will be obliged to ensure strict controls on THC/CBD content, production quality and traceability.

The follow-up of the treated patients will be shared by the prescribing physician and the hospital pharmacy service, which must periodically assess the clinical effectiveness and the occurrence of possible adverse effects.

More information (in Spanish): Ministry of Health press release https://www.sanidad.gob.es/gabinete/notasPrensa.do?id=6761; Royal Decree 903/2025 https://boe.es/diario_boe/txt.php?id=BOE-A-2025-20077

In December 2024, the Ministry of Health presented the 2024–2028 Pharmaceutical Industry Strategy, a roadmap aiming to guarantee access to quality medicines, while promoting innovation and ensuring the sustainability of the health system. The Strategy has been drawn up by the ministries of Health, Finance, Industry and Tourism, and Science, Innovation and Universities, together with the main pharmaceutical industry associations.

The Strategy includes three axes developed through 21 actions encompassing:

- equitable access to medicines, covering unmet needs and ensuring the NHS sustainability;

- research, development and innovation; and

- competitiveness of the sector and its contribution towards strategic national autonomy.

The Strategy will be implemented throughout an “Alliance for the Strategy”, a space that brings together an Inter-ministerial Committee, as well as public and private actors. It will be run by a joint government-industry committee.